HMRC is calling on people to stay vigilant in the fight against fraudsters. The content of this article is taken from gov.uk website and helps you how to spot a fake HMRC emails, sms, and phone calls

Tax refund and rebate scams

Email addresses

HMRC will never send notifications by email about tax rebates or refunds.

Do not:

- visit the website

- open any attachments

- disclose any personal or payment information

Fraudsters may spoof a genuine email address or change the ‘display name’ to make it appear genuine. If you are unsure, forward it to us and then delete it.

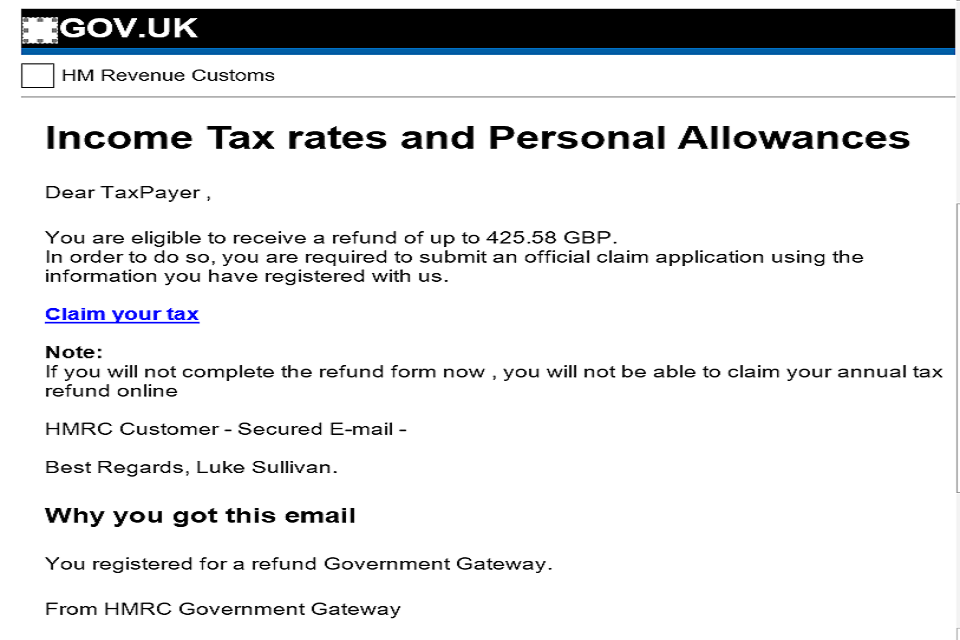

Example of a phishing email and bogus website

An example of a HMRC related phishing email scam is below:

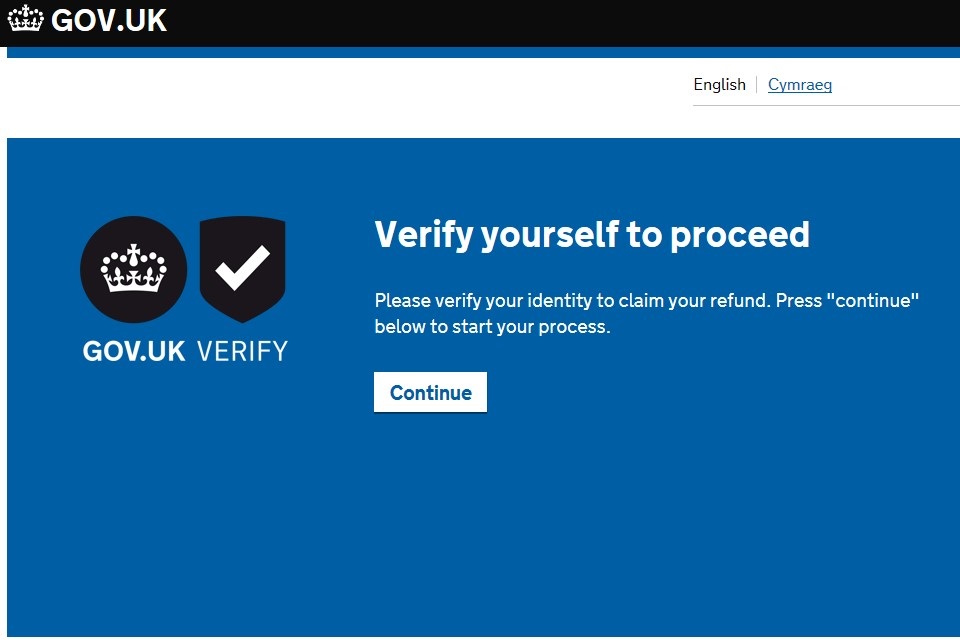

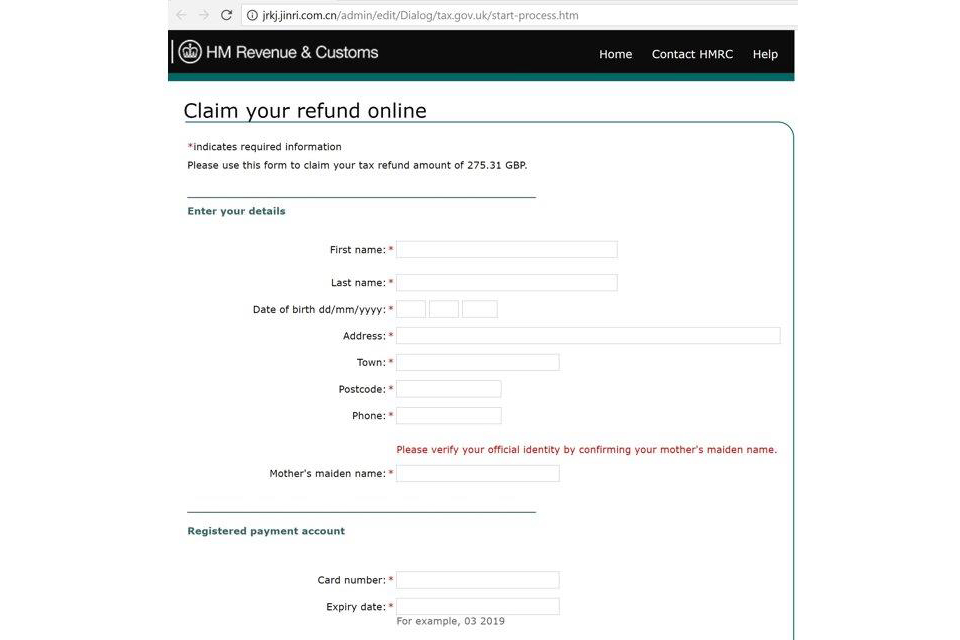

An example of a phishing website designed to trick you into disclosing personal information is below:

Text messages

HMRC will never ask for personal or financial information when we send text messages.

Do not reply if you get a text message claiming to be from HMRC offering you a tax refund in exchange for personal or financial details. Do not open any links in the message.

Send any phishing text messages to 60599 (network charges apply) or email [email protected] then delete it.

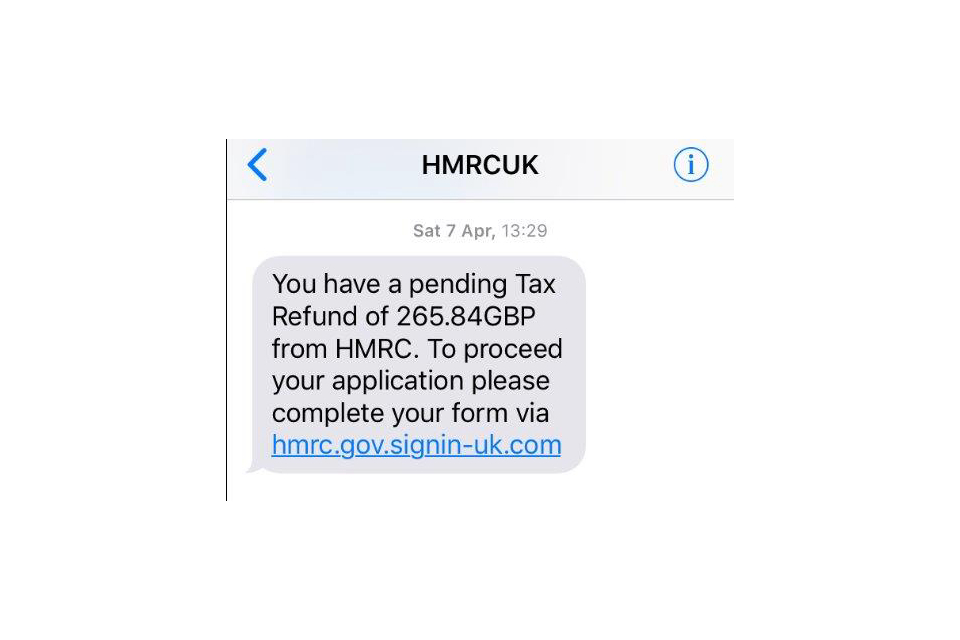

An example of a phishing text message is below:

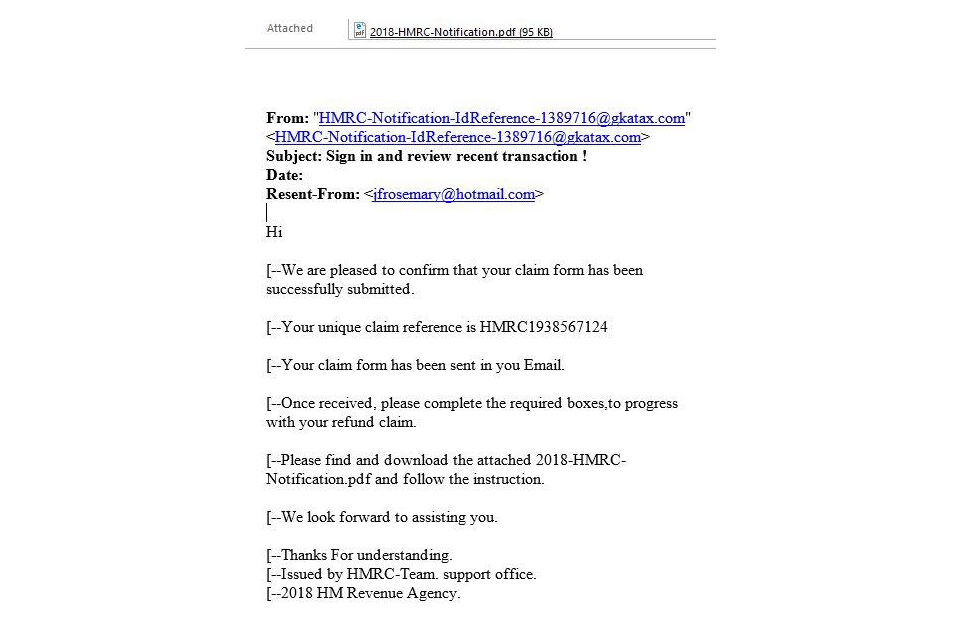

Tax rebate scams containing PDF attachments

HMRC is aware of a phishing campaign telling customers they need to ‘download a PDF attachment’ to get a tax refund.

The PDF attachment contains a link to a phishing site asking for personal or financial information. Do not reply to the email or download the attachment.

Email it to [email protected] and then delete it.

The email has been issued in various formats. An example of this scam is below:

Bogus phone calls

HMRC is aware of an automated phone call scam which will tell you HMRC is filing a lawsuit against you, and to press one to speak to a caseworker to make a payment. HMRC can confirm this is a scam and you should end the call immediately.

This scam has been widely reported and often targets elderly and vulnerable people.

Other scam calls may offer a tax refund and request you to provide your bank or credit card information. If you cannot verify the identity of the caller, HMRC recommends that you do not speak to them.

If you’ve been a victim of the scam and suffered financial loss, report it to Action Fraud.

The calls use a variety of phone numbers. To help our investigations you should report full details of the scam by email to: [email protected], including the:

- date of the call

- phone number used

- content of the call

WhatsApp messages

HMRC will never use ‘WhatsApp’ to contact customers about a tax refund. If you receive any communication through ‘WhatsApp’ saying it’s from HMRC, it is a scam. Email details of the message to [email protected] then delete it.

Social media scams

HMRC is aware of direct messages sent to customers through social media.

A recent scam was identified on Twitter offering a tax refund.

These messages are not from genuine HMRC social media accounts and are a scam. HMRC never use social media to:

- offer a tax rebate

- request personal or financial information

If you cannot verify the identify of the social media account, send the details by email to: [email protected] and ignore it.

Refund companies

HMRC is aware of companies that send emails or texts advertising their services. They offer to apply to HMRC for a tax rebate on your behalf, usually for a fee. These companies are not connected with HMRC in any way.

You should read the ‘small print’ and disclaimers before using their services.

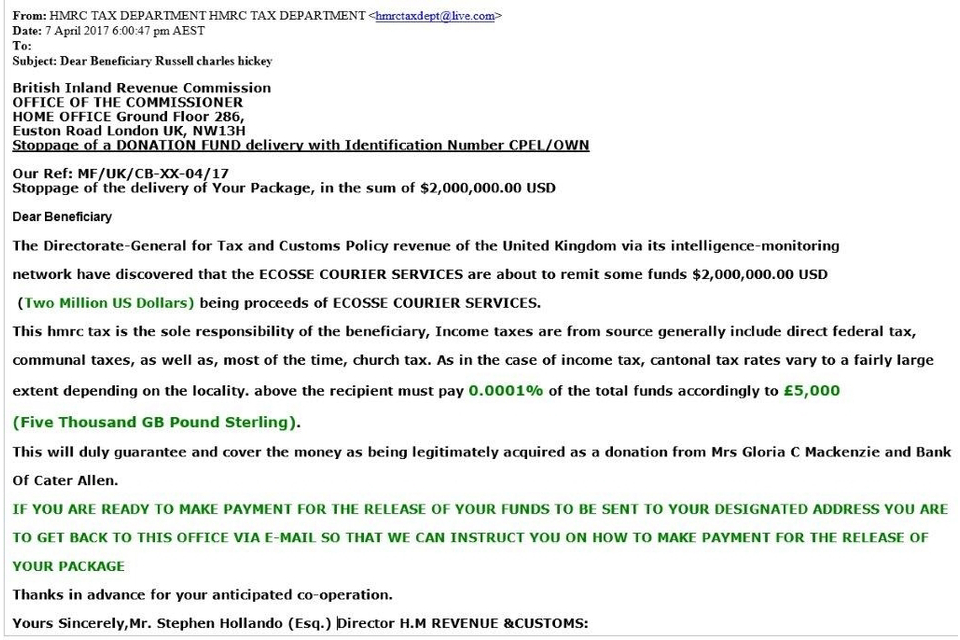

Export clearance process (delivery stop order) emails

Emails which claim that goods have been withheld by customs and need a payment before release are known as ‘419 scams’.

HMRC is aware that customers have received emails asking for personal and financial information or upfront payments in exchange for the fictitious items:

- lottery winnings or prize money, including lottery winnings

- seized goods or packages (held by customs and excise)

- certificates or bonds

- inheritance payments

An example is below:

Fraudsters may sign off such scams using the name of a real HMRC member of staff to make the scam appear genuine. If you’re in any doubt, forward the email to HMRC for verification to: [email protected].